Influenced by hotter-than-expected inflation and employment data for September, the Fed will most likely announce another aggressive rate hike in its meeting next week, raising recession odds. Goldman Sachs believes there is a 35% chance of a…

recession in the next 12 months.

However, despite lingering macro headwinds, the stock market witnessed a relief rally since mid-October, with initial corporate earnings beats boosting investor sentiment. The S&P 500 gained close to 7% over this period.

Earlier this week, Morgan Stanley’s equity strategist Mike Wilson said that the stock market could see a 13% rally in the near term. However, we believe the S&P 500 needs to trade above its 200-day moving average to find strong support.

Investors doubt the market’s continued rally following disappointing big tech earnings, but one could take advantage of the strong uptrend in O’Reilly Automotive, Inc. (ORLY) and Poshmark, Inc. (POSH) by watching them closely.

O’Reilly Automotive, Inc. (ORLY)

ORLY and its subsidiaries operate as a retailer and supplier of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States. It has a market capitalization of $49.12 billion.

Over the last three years, ORLY has grown its revenue at an 11.9% CAGR, while the company’s EBITDA has grown at a 15.2% CAGR.

For the second quarter ended June 30, 2022, ORLY’s sales came in at $3.67 billion, up 5.9% year-over-year. Its gross profit increased 3.2% year-over-year to $1.88 billion. In addition, its operating income increased marginally year-over-year to $798.55 million.

The consensus revenue estimate of $14.15 billion for fiscal 2022 represents a 6.2% improvement year-over-year. Also, Street expects ORLY’s EPS to grow 2.5% year-over-year to $31.87 during the same period.

ORLY’s stock is trading at a premium, indicating high expectations regarding the company’s performance in the upcoming quarters. In terms of forward P/E, ORLY is trading at 24.36x, 86.6% higher than the industry average of 13.05x. Also, it is trading at a forward Price/Sales multiple of 3.47, compared to the industry average of 0.82.

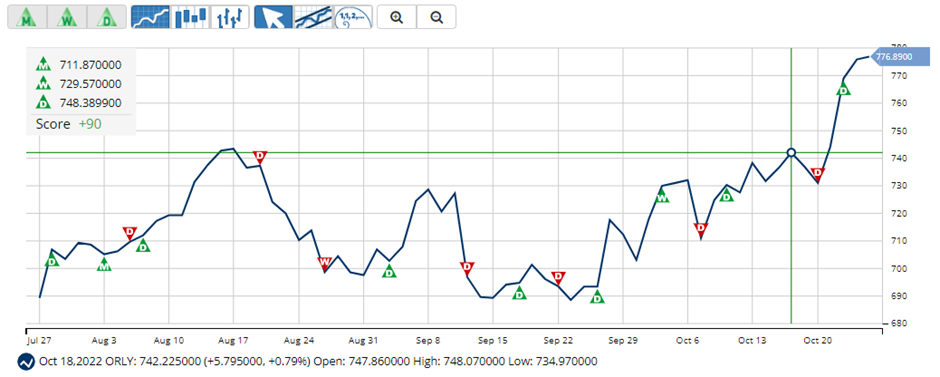

The stock is currently trading above its 50-day and 200-day moving averages of $718.36 and $676.81, respectively, indicating a bullish trend. It has gained 12.7% over the past month to close the last trading session at $775.73.

MarketClub’s Trade Triangles show that ORLY has been trending UP for all the three-time horizons. The long-term trend for ORLY has been UP since August 3, 2022, while its intermediate-term and short-term trends have been UP since October 4, 2022, and October 24, 2022, respectively.

The Trade Triangles are our proprietary indicators, comprised of weighted factors that include (but are not necessarily limited to) price change, percentage change, moving averages, and new highs/lows. The Trade Triangles point in the direction of short-term, intermediate, and long-term trends, looking for periods of alignment and, therefore, intense swings in price.

In terms of the Chart Analysis Score, another MarketClub proprietary tool, ORLY scored +90 on a scale from -100 (strong downtrend) to +100 (strong uptrend), indicating that the uptrend will likely continue. While ORLY shows intraday weakness, it remains…

Continue reading at INO.com

Source: MarketClub

Source: MarketClub