Wary investors will continue to characterize the rising stock market as a bubble ready to pop. That is wholly untrue, to some extent. A stock sector bubble is a better characterization, in light of recent market pops and drops. In January, GameStop’s (NYSE:GME) peak to $483 created a once-in-a-lifetime lift that caught short-sellers completely off guard. One hedge fund may have lost billions at that moment. Since then, the stock fell and both the buyers and short-sellers moved on.

After GameStop’s rise and fall, stocks in the silver mining business rose and then fell sharply a day or two later. Last week, the intense buying in cannabis stocks sent those already with a large capitalization to multi-year highs…

You may guess what happened next.

By the end of last week, the pump faded. Sellers lined up sell orders the very next day, sending the stocks crashing lower. Seven marijuana stocks could go down in flames. Investors should recognize the proverbial pump-and-dump schemes that plague the market today.

The seven stocks to avoid are

- Tilray (NASDAQ:TLRY)

- Aphria (NASDAQ:APHA)

- HEXO (NYSE:HEXO)

- Aurora Cannabis (NYSE:ACB)

- Canopy Growth (NASDAQ:CGC)

- Cronos Group (NASDAQ:CRON)

- Sundial Growers (NASDAQ:SNDL)

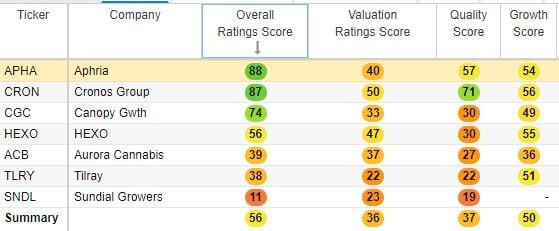

In the chart below, the overall ratings vary from a low of 11 to a high of 88 (pardon the pun). None of the stocks have a good value score.

Marijuana stocks scored by value, growth, and overall

Tilray (TLRY)

In December, Aphria and Tilray announced a merger that will create a $4 billion market capitalization cannabis firm. The deal involves no cash. APHA shareholders will get 0.8381 shares of Tilray for each Aphria to each share owned. When completed, Aphriria will own 62% of the combined firm.

The merger is critical to the survival of both firms. It will save the firms 100 million CAD ($79 million) in pre-tax annual cost synergies. With competition heating up due to years of excess production, Tilray may have a chance of survival.

On Feb. 9, Tilray announced an agreement with Grow Pharma to import and distribute medical cannabis in the U.K. This market is still very small. Investors who paid up to $67 for TLRY stock, at an $8 billion market cap, will end up regretting it. In the third quarter, Tilray posted a net loss of $2.3 million. Revenue was flat year-on-year at $51.4 million.

Expect unexpected integration costs hurting the combined TLRY-APHA firm after the deal closes.

Aphria (APHA)

Aphria traded as high as almost $27 at its peak on Feb. 10 before slumping. In Q2 2021, the company beat expectations as revenue grew. It lost money again in the period.

Aphria posted GAAP earnings losses of 42 Canadian cents per share. Revenue topped 160.53 million CAD. On closer inspections, investors should notice the adjusted cannabis gross margins slumping to 45.9%, down from 56.6% last year. Its beverage alcohol gross margin added just 533,000 CAD in the quarter.

The drop in the average retail selling price (ASP) of medical cannabis is a concern, too. ASP fell to $6.96 a gram, down from $7.38 in the prior quarter. Aphria blamed specific pricing pressures it offered to assist patients in need. Promotional programs also hurt prices. Looking ahead, the negative pressures from the Covid-19 pandemic hurting sales may end. Assuming that the vaccine protects people and the shutdown ends, sales could improve.

Since it is another marijuana stock that loses money quarterly, investors should avoid APHA stock.

HEXO (HEXO)

The decline in HEXO stock’s price reached a point where the company announced a reverse split of shares on Dec. 18, 2020. So, for every four shares owned, investors get one new share. At the time, the stock traded at below $5. To avoid the danger of falling to a stock price below the minimum, management proactively consolidated shares.

Speculators who do not recognize the lack of value a consolidation announcement signifies will lose money. HEXO stock has a good chance of continuing its drop after the temporary spike in recent weeks. In the first quarter, the company posted an 8% growth in adult-use cannabis sales. Adult-use beverage sales grew by 54%.

The weak sequential growth in revenue and…

Continue reading at INVESTORPLACE.com