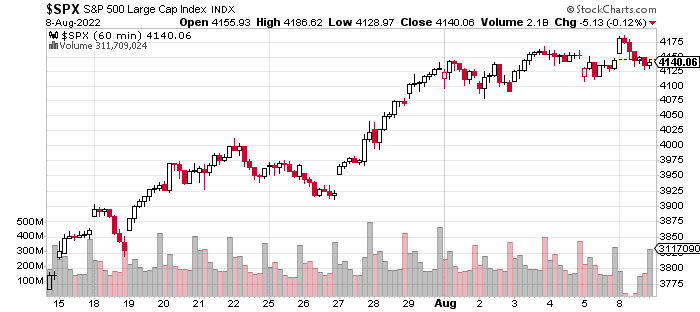

As usual, we will start by reviewing the past 2 weeks… Here is an hourly, 3-week chart of the S&P 500…

Over the last 2 weeks, the S&P 500 (SPY) is up 4.4% as the bear market rally has continued. The gains have been pretty broad-based, but it’s fair to say that most of the strength is concentrated in the indices and what I call, ‘junk stocks’. This category includes GME, AMC, BBBY, etc, which are many of the most infamous meme stocks.

And, seeing these rocket higher proves that shorts are being squeezed as these are some of the most-shorted stocks in the market for the simple reason that they are some of the most egregiously overpriced stocks in the market.

Normally, I have more to add, because there is value to be derived from noting all the subtle developments under the surface that can often be at odds with the widely accepted market narratives.

This isn’t the case right now, because nothing has really changed from the last commentary 2 weeks ago. This is an explosive rally, marked by relentless buying. It’s either a short squeeze/bear market rally or the start of a new bull market. I believe this is the most important question at the moment.

Let me Make My Case for Why This is a Bear Market Rally…

First, let’s just note a couple of things: The market has done a 180 in terms of mood over the last 2 months. It’s yet another reminder that ‘sentiment follows price’.

At the lows, the prevailing narratives were sky-high inflation, a breakdown in growth stocks, a hawkish Fed, and a looming recession that was going to culminate in a significant decline in earnings.

After more than six months of triumph for the bears, they are on the retreat and rethinking their priors due to a nearly 20% rally for the Nasdaq and 15% gain for the S&P 500 (SPY) since the mid-June low. This is clearly the longest and most sustained rally in 2022 and is different in a qualitative and quantitative sense than previous advances in 2022.

This has also coincided with a better-than-expected earnings season and economic data which undermines the recession narrative and increases the odds of a ‘soft landing’. In addition, we had extreme levels of bearish sentiment, high levels of fund managers holding cash, and very low levels of stock ownership, specifically for tech stocks.

Given these developments, it’s a good time to delve into some individual issues to help us answer the million-dollar question.

Inflation

Possibly the most potent bearish threat facing the market in 2022 is inflation which kept creeping higher, reaching a level above 9% in the last month that hasn’t been seen in decades. High inflation means a hawkish Fed and higher short-term rates which is particularly negative for financial assets.

After all, why would investors take risks in terms of borrowing money or buying stocks if the risk-free rate of return is sufficiently attractive.

Adding to this risk were energy prices. These were climbing higher, entering 2022 but accelerated due to the Russia and Ukraine crisis. Nasty side effects have included soaring electricity prices and broad-based gains in oil, coal, natural gas, etc.

The issue is also conflated with national security and politics which means that the US and EU are willing to absorb these higher prices in order to oppose Russia’s incursion into Ukraine.

There doesn’t seem to be a resolution to the conflict between Russia and Ukraine, but there are some positive developments in terms of inflation. Leading indicators are pointing lower. Supply chain issues are being sorted out with retailers now discounting prices due to excessive inventories.

Auto production is returning to full capacity and the housing market has slowed in a major way. Most importantly, there is relief in terms of lower gasoline prices.

Growth Stocks

Growth stocks have been kind of a leading proxy for the market. Many of the frothiest, peaked in the spring of 2021, while others topped later in the year. This was well before the broader market which topped in January of this year.

Interestingly, the inverse took place recently as many growth stocks bottomed in mid-May and made a higher low in mid-June, even though the indices and most stocks made lower lows in June.

Currently, growth stocks have been the strongest performers during this rally. One reason is that moderating inflation is leading to lower rates which puts a bid underneath growth stocks. The other is that these stocks were heavily shorted which means that shorts are being squeezed.

It’s also worth noting that ‘junk’ growth stocks with no earnings and high valuations are leading the rally, while higher-quality growth stocks are lagging. This could be interpreted as a lack of institutional participation in the rally.

Recession + the Fed

In May and June, the calculus seemed simple. The Fed’s hawkishness and determination to crush inflation were going to result in a recession.

This scenario could still prove to be correct, but it’s clear that the economy is much more resilient than expected. This is evident in the recent jobs report which…

Continue reading at STOCKNEWS.com