The horror of last week’s earnings came just in time for Halloween… Some of those losses were downright scary. However, the holiday also marks the beginning of a new week, and with a new week, comes new opportunities for us to…

become smarter, more creative investors. Creativity is often an under-appreciated key to successful investing. It enables us to look at a bevy of information and make better, more informed decisions with how we deploy our capital.

This is the key that unlocked the most recent insight one of my colleagues, JC Parets, and I used to make this discovery that we have yet to see the mainstream financial media talk about at length.

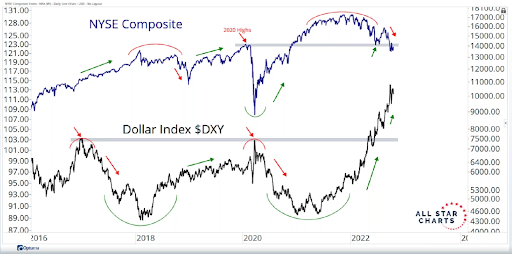

The insight? The recent correlation between the market and the U.S. dollar Index (DXY).

Recently, when the strength of the dollar increases, stocks’ values decrease. This negative correlation has been working to a tee for the past couple of weeks now. To better illustrate this point, take a look at the graph below (which some of you may have already seen) to see how this worked out.

The reason for this, when the largest companies of the world operate in foreign countries, the strength of the dollar can actually work against them because of exchange rates being moved out of whack. This strength works as yet another headwind for stocks of businesses that operate internationally.

Take Apple (AAPL) for example. With all the business it does overseas, this has to be eating into the company’s bottom line, even if not all that significantly. When coupled with everything else that’s going on, one more weight tied to the ankles of these companies is enough to drag them down further.

For investors, however…

Continue reading at WEALTHPOP.com