I’m stating the obvious when I say the markets (yes plural) currency, commodity, bonds and stocks have been extremely volatile as of late. This has led my students and I to apply strategies such as ratio spreads and unbalanced iron condors to benefit from…

the pumped up premiums. It takes a bit more hands on active management, however, one needs to adapt to market conditions.

And so far it has been worth it. Options360 keeps grinding higher, now up 22.3%. This compares quite nicely to the SPDR S&P 500 (SPX) being down 25% for the year to date.

To see how Options360 beats the market each and every year, click here!

But, back to today’s topic.

What do we mean when we discuss volatility or the Greek term Vega?

Options traders sometimes use these terms interchangeably, and while they are related, they are two distinct concepts.

Volatility is one of the five inputs used in the basic Black-Scholes options pricing model.

Higher volatility means higher option prices. That’s because higher volatility means greater expected price swings.

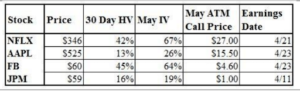

So it follows that stocks like Netflix (NFLX) and Meta (META) have higher volatility readings, and therefore, higher-priced options than more stable companies like Apple (AAPL) or JP Morgan (JPM).

Take a look at this table:

Despite Apple having a higher underlying stock price than Netflix, its at-the-money May call is actually much lower in price than Netflix.

And note that both JP Morgan and Meta are trading around $60, but the latter’s call is nearly five times the price.

This is almost entirely due to the differences in implied volatility (IV). This is because Facebook –sorry, Meta– is far more likely to make a huge move after earnings than JP Morgan.

Last quarter provided a perfect example of this…

Continue reading at WEALTHPOP.com