The slow, then sudden, collapse of Credit Suisse (CS) put a lot of large asset management company money at risk.

But as an individual investor, you may think you’re not affected by the failure of a Swiss bank now being acquired by another Swiss bank.

Unfortunately, a handful of popular investment products could go down the drain along with Credit Suisse.

Here’s how to see if your investments are at risk…

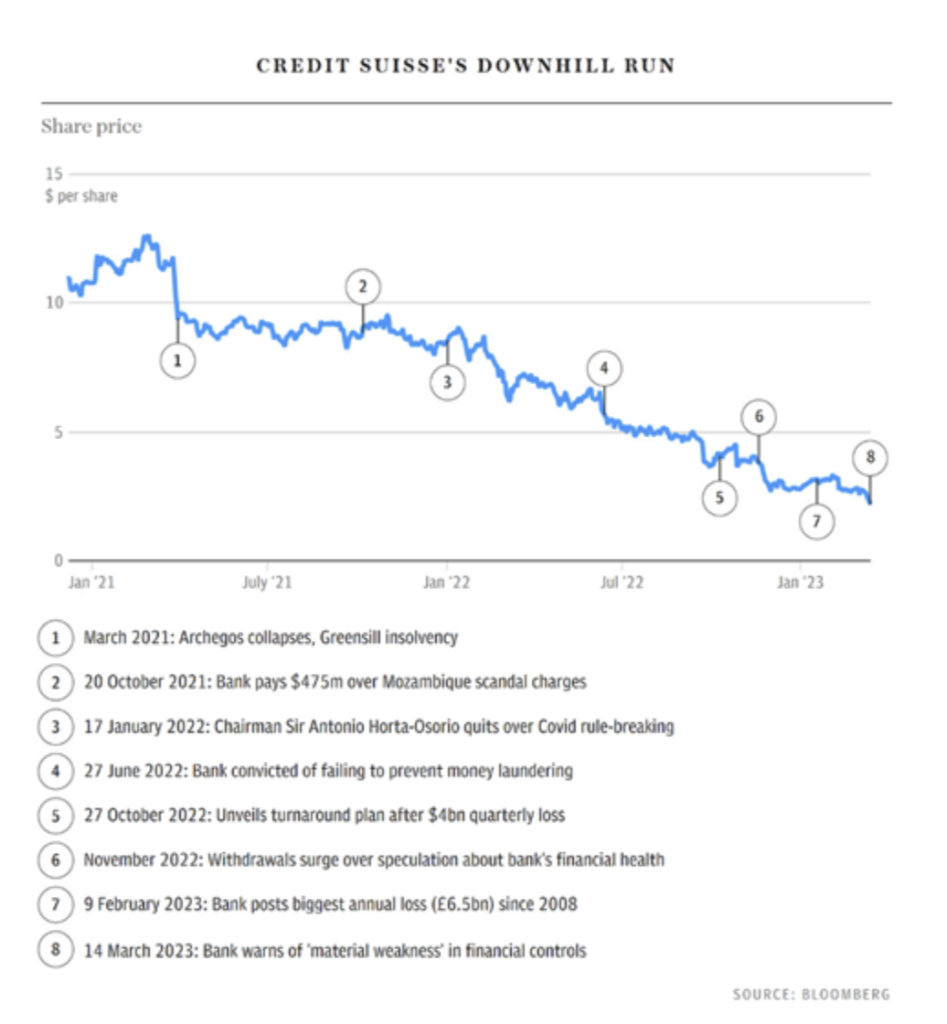

My friend and fine wine investing account manager, Suthagar McNamara-Rajeswaran of Oeno Group, sends a daily email that recaps political and financial news. He recently included this chart in one of his daily notes:

The Swiss bank has suffered (self-inflicted) a string of crises, which will soon culminate in the bank’s end as a separate entity. Investors who bought common stock or Credit Suisse bonds face losses of 100%—or nearly that. Last week it was announced the bank would completely write off $17.3 billion of outstanding bonds to increase core capital. These bonds were owned by companies like Pacific Investment Management Co. and Invesco Ltd.

Credit Suisse also manages some retail products that put investor money at risk. Three popular covered call strategy funds are more dangerous than they look. Here is the list…

Continue reading at INVESTORSALLEY.com