It is that time of the quarter again. Earnings season is indeed upon us. Yesterday, I hosted a webinar detailing my approach to trading earnings. The first trade recommendation was issued live on the call and we’re already booking a…

67% gain. But there’s still time to get in so you don’t miss any of the some 30 trades I expect to make over the next six weeks.

During the event, I explained my process and revealed the strategies that led to the Earnings360 service-producing consistent profits for 16 out of 18 quarters in the past four years.

Honestly, even under ideal circumstances, earnings can be extremely tricky to trade, with many moving, as well as unknown parts.

Will the company miss or beat expectations? What will be the guidance? Will traders “sell the news,” or buy into “the unknown,” believing the recent decline has priced in a near-worst-case scenario?

The Earnings360 presentation here for FREE

However, there’s one predictable pricing behavior that savvy option traders use to make steady profits. Given all the recent volatility and numerous unknowns, options premiums will be at record-high levels as market-makers must price options for outsized moves.

So, how do you trade earnings in a world without guidance? Here’s a quick guide that rests on taking an options-centric approach…

Utilizing Post Earnings Premium Crush (PEPC)

No matter what a company reports, or how the stock reacts, the options will undergo a Post Earnings Premium Crush (PEPC). This is my way of labeling how implied volatility contracts, immediately following the report no matter what the stock does.

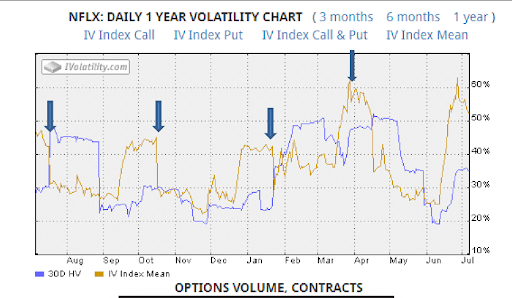

As you can see, the repeating implied volatility pattern of Netflix (NFLX) options is spiking and retreating in the quarterly reports.

You’ll often hear traders cite what percentage move options are “pricing in” the earnings. The quick, back-of-the-envelope calculation for gauging the expected move magnitude is to add up the at-the-money straddle.

There are articles that do a great job of explaining how to use the straddle to assess expectations and potentially profit.

Once option traders are armed with this knowledge, they advance to using spreads to…

Continue reading at WEALTHPOP.com